Budget 2014: Key points and reaction

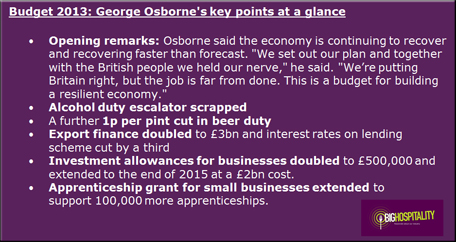

Osborne's so-called 'Budget for the makers, the doers and the savers’ saw him state that he was once again scrapping the alcohol duty escalator and cutting beer duty by another 1p to help 'responsible drinkers' continue to enjoy a pint and safeguard the future of pubs.

But, amidst another afternoon full of big announcements and political grandstanding, there were, as usual, some key issues that weren’t mentioned. A VAT cut - which hotels, restaurants and pubs have long been campaigning for – was once again avoided entirely; as was a change in the Enterprise Investment Scheme (EIS) to specifically include hotels.

Find out what the industry thinks on some of the key factors of the 2014 Budget in our reaction round-up.

Budget 2014: Hospitality industry reaction

Ufi Ibrahim, chief executive, British Hospitality Association (BHA): “The UK hospitality and tourism industry is operating in the most fiercely competitive international market and we need to be looking outwardly and creating financial policies which allow us to better compete with countries who are already acknowledging this like France, Germany, Spain and Italy.

“Today’s Spring Statement showed some small signs of recognition from the Chancellor on issues like APD, the Apprenticeship Grant and the Annual Investment Allowance, which the BHA welcomes, but there are other more lucrative ways to increase our competitiveness as a nation, for example by funding more improvements to obtaining tourist and business visas and the reduction of tourism VAT.”

Martin Couchman, deputy chief executive, BHA: “Hospitality businesses should be brought back into the Enterprise Investment Scheme to help secure necessary funding for refurbishment of the premises. Some of our smaller regional members have told us they have found it difficult to secure bank finance, with the result that necessary refurbishment and improvement of premises cannot take place.

"Another driver of growth which our members would have liked to see is a cut in employer’s NI to create more employment opportunities.”

Mike Benner, chief executive, the Campaign for Real Ale (Camra): “CAMRA is delighted to see the Chancellor implementing an unprecedented second consecutive cut of a penny in beer duty. This is not only about keeping the price of a pint affordable in British pubs but helping an industry which has been in overall decline continue on its long road to recovery. CAMRA cares greatly about the future of the Great British pub and it is clear from this Budget announcement that the Government do too.

“Keeping the price of a pint affordable is vital for the long-term health of the pub sector and CAMRA would hope this latest vote of confidence in British pubs will go some way to slowing the rate of closures, by encouraging more people to make use of their local this summer.

“No doubt many of CAMRA’s 160,000 members will be raising a glass to the Chancellor this evening to toast another brilliant Budget for British beer drinkers.”

Brigid Simmons, chief executive, British Beer & Pub Association (BBPA): “This is fantastic news, and George Osborne is again the toast of Britain’s brewers, pubs and pubgoers. It will protect over 7,000 jobs over two years, mostly jobs of younger people in Britain’s pubs.

“It also shows that the Government has understood our case, that taxes on British beer had become far too high, and action was long overdue.

“I hope this becomes a trend in future budgets for this British-made, lower-strength drink.”

Andrew Cowan, country director, Diageo Great Britain: “The Chancellor has today given a huge boost to one of Britain’s most successful industries. From Scotch whisky to London Gin, British spirits are admired and enjoyed around the world.

"In freeing the industry from a debilitating tax policy the Government has given a show of support for these quality products. That will benefit the industry not just at home but also help us as we fly the flag for British business across the world.”

Katie Corrigan, Hospitality & Leisure team, Tods Murray Solicitors: "The announcement in the Budget that whisky duty is to be cut is excellent news. The industry has had a tough time of late with the UK market having shrunk in the last year. This move goes some way to helping alleviate some of the pressures and let the sector focus on achieving growth."

"The changes to alcohol duty are also welcome and show an appreciation of the impact of tough trading conditions over the last few years. It is hoped this move will go some way to getting more people back into pubs and bars."

Kate Nicholls, strategic affairs director, ALMR: “We are pleased to see the Chancellor continuing the good work started last year and we welcome the scrapping of the alcohol duty escalator and a penny off a pint for the second consecutive year. Additionally we applaud the steps taken to reduce the cost of living burden and efforts to put more disposable income back into the pockets of families.

“Extension of apprenticeship grants for small businesses ensures that the eating and drinking out sector can continue to lead the way in apprenticeships. Likewise the doubling of investment allowance and extension of employment allowance gives pubs, clubs and restaurants a chance to continue doing what they are already doing, namely creating jobs and investing in people.

"The Chancellor’s actions today to help businesses are most welcome but there is even more to do to achieve a fairer deal for licensed hospitality."

Tim Hulme, chief executive, British Institute of Innkeeping (BII): “Today the Chancellor has done something extremely positive for pubs and the tens of thousands of people who rely on them to make a living.

"Cutting duty for the second year running and freezing cider duty helps keep pub visits affordable for the British public at a time when many are still feeling the post-recessionary pinch. It also means that publicans don’t have to face the impossible task of absorbing extra cost and making cut-backs at a time when they are playing such a vital role in creating new jobs to fuel the fledgling growth we’re seeing in the UK economy.

"I am really heartened by the Chancellor’s continued support for our industry and the vital role pubs play within their communities.”

Marc Glazer, chief executive, Boost Capital: “Evidence that gross lending to SMEs is 13 per cent higher in 2013 to 2012 must be welcome news for small business owners who are the driving force behind the UK economy.

"The Treasury’s move to develop a route for those businesses to find alternative lending is very encouraging, especially for those (often in sectors without significant assets to leverage) who struggle to meet the stringent lending standards set by high street banks. Alternative lenders who often use different criteria to judge whether to lend to a business offer an important option for UK businesses with strong ambition to grow.”

Nigel Wright, chief operating officer, TCG pub group: “The Budget is really positive news for the trade. Another reduction in the rate of duty on beer, along with the freeze in cider duty, is particularly good news, especially in a World Cup year. A well-served pint at the pub is an essential accompaniment to meeting friends or watching the match for millions of consumers, and it’s important that it remains an affordable treat.

“The end of the duty escalator on wine and spirits is a welcome move, and all credit goes to the trade bodies that co-ordinated the campaign to persuade the Treasury of its merits. We’ve invested significantly in both our cocktail range and wine lists over the past year, supported by staff training, and an end to above inflation increases in duty means we can expect to continue to see the benefits in terms of increased sales.”

“The further significant increase in the income tax threshold to £10,500 next year is also a welcome development. Both our customers and our employees will see the benefits of the increase in the threshold to £10,000 in their April pay packets, and the trade can expect to benefit from a significant feelgood factor.”

Julian Grocock, chief executive, Society of Independent Brewers (SIBA): “SIBA applauds the Chancellor’s decision to take another penny off the pint, following last year’s historic decision to scrap the unpopular escalator. It is good to see that this government believes in providing long-term support for the British brewing and pubs industry.

“SIBA’s Budget submission to the Treasury this year was based on the very positive impact of the 2013 duty cut on the local brewing industry. Our members now feel more confident about the long-term prospects for their breweries, and are investing in them by buying new equipment, recruiting new staff or opening new pubs.

“We must also thank Andrew Griffiths MP, whose tireless work on behalf of British beer and brewing ensures that our arguments are heard at the highest level in government.”

Survey

Budget 2014: Were you happy with George Osborne's announcement?

YES - These new announcements will help my business over the coming year

39%NO - George Osborne missed a number of more important issues such as VAT

61%