Business Profile: Rossopomodoro

In its country of origin Neapolitan pizza specialist Rossopomodoro is a novelty. The odd train station-based franchise aside, Italy doesn’t do restaurant chains. Yet a trio of ex-professional rugby players have spent the past 25 years growing their Vesevo Spa holding company to 100 or so restaurants, of which 70 are Rossopomodoros (other formats include a chicken concept and Ham Holy Burger, an Italian-themed gourmet burger joint).

Rossopomodoro is hands-down Italy’s most successful restaurant export, with pizzerias in major cities all over the world thanks to a collaboration with Eataly – the globetrotting group of upscale Italian food markets that include a food court – plus a number of one-off franchise projects in locations as diverse as Turkey and Iceland.

But of all worldwide markets, the Naples-headquartered group views the UK as having the most potential for growth. The brand arrived on these shores in 2006 and speedily set up three company-owned restaurants in prime central London locations. But its landing was a little bumpy to say the least. Such was its success in its home country, Rossopomodoro’s owners simply picked up the format and plonked it on the UK high street. It didn’t quite work.

In 2011, former Nando’s regional director Handley Amos was hired to improve the group’s fortunes and immediately identified two key issues with the proposition, as well as some problems specific to each of the three sites.

“The Notting Hill restaurant was spread over several different levels and was in the immediate vicinity of a dozen other pizza restaurants. I got rid of that one straight away,” says Amos, who started his career in the ’80s with My Kinda Town, a prolific and influential restaurant group that launched the careers of many industry big-hitters, before managing various restaurants in South Africa. “There were some issues but it was all fixable. I loved the feel of the brand and, of course, the pizza from day one and I knew exactly what to do to make it work, which was exciting.”

Amos joined Nando’s UK business in 1999 when it operated just 12 restaurants and stayed for 12 years, leaving with responsibility for over 100 of the chicken chain’s restaurants in London and the south-east. It’s almost unthinkable now, but the South African-born Nando’s wasn’t an overnight success either. The team had to work hard to transform it from a rather unrefined takeaway-focused business into the fast-casual powerhouse it is today. It’s precisely this experience that makes Amos the man to run another imported brand that wasn’t fulfilling its potential.

The 70-odd Rossopomodoros in Italy have a slick, modern look that is intended to be the very antithesis of the family-run pizzerias with which they compete. This makes sense in a country where restaurant chains are a novelty, but a different approach was necessary over here where pizza-focused brands account for a big slice of the casual-dining market.

“The look in Italy is design-led and northern Italian rather than southern. I decided to recreate the vibrant, rough-and-ready feel of Naples,” says Amos, who has now opened several Rossopomodoros that, it must be said, nail that rustic, thrown-together aesthetic so beloved of restaurant groups these days.

Culling the menu

The main problem with the old Rossopomodoro format, however, was the menu. “It was far too expansive. At one point there were 30 different pasta dishes on offer,” Amos recalls. “In Italy, it is generally expected that a menu will have something for everyone, whereas in the UK people tend to go out with a particular category of food in mind and Amos drastically reduced the menu to a core of pizza and pasta dishes and a comparatively small number of supporting items. Among the categories ditched were fish and meat dishes, some of which took in excess of 20 minutes to prepare. This was fine in Italy where a quick lunch in a restaurant is an entirely alien concept, but far too long for a casual-dining brand looking to make it over here.

The Change Capital Partners-backed group has now opened more stand-alone restaurants in London – including sites in Camden, Hoxton and Swiss Cottage – and has also expanded outside the capital

The group made its regional debut in Selfridges Birmingham in 2011 and opened two restaurants with John Lewis last year – one in the store’s flagship Oxford Street branch that also includes its parent group’s fledgling Ham Holy Burger concept, and another at John Lewis Newcastle.

This cull of dishes presented an obvious opportunity to de-skill the kitchen, but Amos has resisted. “As you grow, you de-skill the cooking. That’s pretty much a given. But I believe, in Rossopomodoro’s case, a high level of skill in the kitchen is essential to serve the food at the level we want.”

Every person in the business who touches a pizza has to be Italian. While that sounds like a recruitment nightmare it’s actually Rossopomodoro’s trump card. The group employs several hundred pizzaioli and pizzaiole in Italy and many are happy to spend a few years spinning pizzas on these shores.

“I’ve tried making our pizza myself. It might look easy, but it’s not. It’s second nature to these guys. Most of them are Neapolitan and were pretty much raised in pizza kitchens,” says Amos, who admits that the stereotype of male Italian pizza chefs as espresso addled, highly strung mother’s boys is not entirely without foundation. “There’s always a level of truth in any rumour. Sometimes I wake up in the middle of the night and think what have we done? But, in general, we have a fantastic team and we have a lot of fun together,” he says.

Rossopomodoro is an obvious place for young Italians to wait tables while in England too, which has resulted in 90 per cent of the group’s UK workforce being Italian. “I’ve tried to build a home away from home. A lot of people come and work here for six months and end up staying with us for three years. At the end of the day I don’t want them to go home,” he says.

Italian-focused sourcing

Along with its staff, the other thing that perhaps sets Rossopomodoro apart from a lot of the mainstream competition is its focus on quality ingredients from Italy. The group’s mozzarella is flown in daily from Campagna, the majority of its produce is shipped direct from Italy via road and it even brings in water from Naples to make its dough.

Pizza and pasta usually provide an unusually high GP but the group’s extreme sourcing policies change the equations somewhat. “It’s quite drastic actually,” says Amos. “Although our pricing is similar to that of our competitors, many of our menu items cost more to make. The idea is that once people have it they’ll see the difference and come back.”

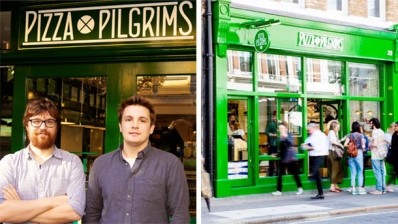

The menu remains fairly expansive, especially when compared with the new players on the pizza scene, including Franco Manca, Pizza Pilgrims and Homeslice. In this area, Rossopomodoro is more familiar as a branded Italian proposition ticking off the same crowd-pleasing dishes and menu categories as the big four: PizzaExpress, ASK Italian, Zizzi and Strada. There are various types of bruschetta, an antipasti

menu that include polpette in tomato sauce, aubergine parmigiana, salads and a large selection of familiar pasta dishes.

That said, it does offer a handful of more unusual dishes. There are hearty bowls of minestre, which is somewhere between a soup and stew and packed with beans, but most alien of all are the large fresh cheeses it serves.Rossopomodoro’s whole burrata (£14.95) and mozzarella di bufala (£15.95) are rarely ordered by non-Italians but are like catnip to expats.

As a nation, the UK has been largely weaned on US-style pizzas (think Domino’s and Pizza Hut) and the pizzas served by the big Italian chains – a cross between thinner Roman-style pizza and Naples pizza. As such, lots of menu real estate is devoted to shouting about the brand’s authentically Neapolitan credentials. “If you live in London, good Neapolitan pizza is everywhere,” Amos explains. “But in many areas of the UK, it’s pretty much unheard of. In Newcastle, our main battle is getting people to understand good Neapolitan pizza. People need to realise that what we serve is exactly how it is supposed to be or they might come away disappointed.”

On the top of Rossopomodoro’s menu there is a diagram of a pizza that forewarns customers that the cornicione (crust) may arrive charred and to expect the middle of the pizza to be wet with sauce. The restaurant’s pizzas are accredited by the famously strict Associazione Vera Pizza Napoletana that insists on a number of standards, including a slow-proofed dough and a 485°C wood-fired oven (Rossopomodoro’s pizzas take just 60 seconds to cook).

With promoting greater familiarity with Neapolitan pizza being high on the group’s agenda, he sees the upcoming national rollout of rival Neapolitan pizza chain Franco Manca as largely a good thing. “They too will make people fall in love with Neapolitan pizza. Clearly they’re the competition, but their presence will help us grow,” says Amos, who recently tested the waters in Scandinavia for Vesevo Spa with a company-owned restaurant in Copenhagen.

Restaurants in retail

The group’s increasingly close relationship with John Lewis looks set to help it expand further into the regions, with two more concessions expected to open in the north of the country this year. Running restaurants in department stores carries with it a number of advantages. There’s no premium and – like most shopping centres – rents are turnover linked, which further reduces ingoing investment. Amos has noticed some operational differences, including a slightly reduced dwell time and lower spend per head, but he says the positives far outweigh the negatives.

While the group’s opening schedule is currently focused on concessions, Amos wants to maintain a balance between these and standalone restaurants and is on the hunt for a flagship site in central London. He

isn’t willing to reveal how many Rossopomodoros he thinks the country can take but plans to open between two and four restaurants per year for the foreseeable future. Clearly, this is a pizza business that doesn’t want to stretch itself too thinly but its cautious expansion plans belie a savvy operator that understands how to scale a business up, specifically the importance of having structures in place before you need them.

“We’re a small team so the approach is necessarily both organic and selfsufficient,” he says. “You’ve got a choice of borrowing lots of money and going really fast or going slowly and doing it within your own means. We’re not trying to explode and grow as fast as possible.”

Amos is too modest to mention it in the interview, but a lot of the changes that he’s made in the UK business have been rolled out to the group’s other restaurants. He is, therefore, held in high regard by the company’s overall bosses, despite his limited Italian language skills. “I understand some of it, but I often have to guess the words I don’t understand. I sometimes come away with the wrong end of the stick,” he says. “Luckily the important meetings are conducted in both Italian and English.”