German Gymnasium: Behind the scenes at D&D London’s latest restaurant

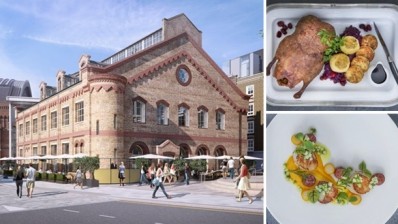

German Gymnasium is huge. Gigantic Gymnasium would be an equally fitting name for D&D London’s freshly opened site in King’s Cross, such is the space it occupies (13,000sq ft, to be precise). As Des Gunewardena, chairman and chief executive of D&D, jokes: “The roof is so high, you could build another entire restaurant in the void we have here.”

It doesn’t come as a surprise, however. Gunewardena, along with managing director and D&D co-owner David Loewi, have a history of opening and operating large, and often very large, restaurants. Their company also runs Quaglino’s, Fish Market, Crafthouse, Le Pont de la Tour, Plateau and Skylon as well as South Place Hotel – and numerous other sites – none of which can be described as diminutive.

“We’ve got more small restaurants than large ones, but it’s fair to say that as a business we are keen to take on large spaces,” continues Gunewardena. “We’ve never seen a trend away from people enjoying larger spaces. A lot of restaurateurs chase 3,000sq ft buildings – people like Bill’s and Côte – but they’re not after 10,000-15,000sq ft sites in King’s Cross.”

What is more surprising about their latest venture is that it’s something of a departure for them in that it’s a German restaurant. Well, kind of. Named in honour of the Grade II-listed building’s history as being constructed for the German Gymnastics Society, German Gymnasium is of the grand European brasserie tradition with which Londoners are already familiar thanks to places such as The Wolseley and The Delaunay.

With a menu that includes schupfnudeln – a type of dumpling or thick noodle in southern German and Austrian cuisine – goulash, schnitzel and herring ‘hausfrauenart’, as well as a section dedicated to German sausages – not to mention a desserts list that features Black forest gateau, apple strudel and Sachertorte – overseen by German-born executive chef Bjoern Wassmuth, it doesn’t pull any punches either when it comes to classic central European cuisine.

“It’s not pure German food,” says Gunewardena. “But we felt that because it is a German building, we wanted to use its history. So why not German food?”

Basing a restaurant concept on a building’s past life can be a dangerous tactic, particularly one that has had more association with office space and exhibitions in recent years than with 19th-century gymnasts, yet there are other, more compelling, reasons why the duo were attracted to the idea of opening a European brasserie. Loewi’s father was German meaning that he grew up eating German food. He also has previous with the format having helped set up The Wolseley with Chris Galvin, Chris Corbin and Jeremy King. “It’s quite popularist food,” he says. “Here we are open for breakfast, lunch, afternoon tea and dinner. It’s a proper all-day offer, which is great for this area.”

Building on the heritage of the property, so to speak, is an approach that has paid dividends for the company in the past.

“We tend to start from a property and develop the concept around the building and the interior,” adds Gunewardena. “We don’t just take on large blocks but rather interesting places that create great theatre. We’ve been doing it this way for 20 years.”

The cuisine aside, German Gymnasium is true to form for D&D in a number of ways. Along with its scale – the site has 447-covers, including 88 al fresco seats – German Gymnasium has the feel of some of the other larger restaurants in the group; its interior is smart and classic rather than being overtly opulent. It is more safe than sexy, I suggest.

The classic approach

We are sitting on the capacious ground floor of the restaurant, home to the grand cafe element of the building – the restaurant is on a mezzanine floor above. The all-day space is overseen by a huge clock that not only serves as a constant reminder of the time for people waiting to catch a train across the way, but chimes daily at 4pm to signal the beginning of the German tradition of kaffee and kuchen (coffee and cake). Maybe it’s the mocha-coloured seating, the large central flower arrangements or just the light space itself, but German Gymnasium has a certain familiarity about it.

It’s an observation that doesn’t go down well with the pair, who are genuinely stung by the remark. But it’s not intended as a derogatory one. As operators of 28 well-established restaurants in London as well as a hotel, and with operations in Paris and New York, Gunewardena and Loewi are the masters of building restaurants with longevity. Rather than ape the dining trends of the moment, D&D instead follows its tried-and-tested formula of opening classic restaurants that stand the test of time. They know their customers and understand that for every ostentatious Sexy Fish or stripped-back Nordic dining room there also needs to be a more traditional approach to restaurants. If I were to sum up D&D’s restaurant portfolio in one word it would be ‘solid’.

“We’re aware of trends but we make judgements on what we know and see,” defends Gunewardena, “people come [to German Gymnasium] for the sommeliers and the flowers. We’re not doing downtown New York but rather more fine dining in an industrial space. We’re not getting down and dirty with the kids here or suddenly doing street food or barbecue. Our philosophy is to create classics not trendy restaurants. We are the people with the longest-standing restaurants in London, which means we are doing something right.”

The same goes for other restaurants in the group. “Le Pont de la Tour is not remotely trendy, it’s safe,” says Loewi. “Every restaurant has its place and we want Le Pont to remain broadly that for the next 30 years or so.”

What bristles with the pair much more, however, is any notion that this approach to restaurants implies they are pragmatic rather than daring and that they are unwilling to take risks, something they vehemently deny.

“We’re not bling. We don’t go about wearing Versace clothes but we do things that really interest us,” asserts Gunewardena. “We are not pragmatists, we are people who like projects and creating new concepts. We take more risks than any other restaurateurs I know. We opened a night club in Paris. Nobody in London would do that.

“We opened The Great Eastern hotel [before they became D&D] and put £75m into it (they sold it for £150m in 2006), no other restaurateur would dare think about doing that. The idea that Sexy Fish is the most daring thing you can do is ridiculous. We’re probably the boldest risk takers there are in the industry. We went into New York and invested £25m there, including retail and a restaurant. It didn’t make any money. South Place Hotel was a big investment and a gutsy thing to do. People thought we were nuts. We have taken some enormous risks.”

Indeed, German Gymnasium is by no means risk averse. As the single biggest individual restaurant that D&D has opened in the past 10 years, and with an offer that is less than obvious for King’s Cross, it can hardly be described as a safe venture. Yet it is perhaps more mainstream than Gunewardena and Loewi might have originally planned. “When we first saw the site we had an idea of doing something along the lines of Eataly,” says Gunewardena, “but King’s Cross said they would rather we did something more in line with what we already do.”

Working a wide portfolio in today’s ultra-competitive restaurant world, where large, ambitious restaurants are opening up with alarming regularity, D&D’s new launches arguably don’t have the impact of when the company first started back in the 1990s as Conran Restaurants (Gunewardena and Loewi led a buyout of the business in September 2006 to create D&D).

“When we opened Quaglino’s [in 1993] it was packed. It had no competition. There is far more intense competition now than 20 years ago, 10 years or even five years ago,” admits Gunewardena. Yet the company still has the power to please and surprise its legions of regular customers, he adds. “You probably feel [the similarities between our restaurants] far more than the general public does because you are in the industry,” he tells me. “It is of supreme unimportance for customers to know who owns a restaurant.” That said, D&D has a core clientele that must surely be in theback of its mind for every opening. The company has excellent links with many loyal corporate clients that have a relationship with D&D as a whole and that look across its portfolio when considering where to hold events and parties.

It also runs Club D&D, which recognises the loyalty of its most regular guests. Those who have dined at any of its restaurants on at least three occasions are eligible for membership. There are currently 33,000 members in the club and this figure is set to grow to around 100,000 in the next couple of years.

Opening restaurants within the D&D family is also useful when it comes to staff recruitment and retention, says Loewi. “With a restaurant company of our size and scale you can offer great careers and opportunities to staff. Staff do move around the restaurants and stay with us.”

Having a portfolio of different restaurants in both size and style has other benefits. “We devolve operational responsibility,” says Gunewardena. “When things go well it’s fantastic as it means you don’t have to manage each separate restaurant. But when things don’t go so well we have to be able to support and intervene. When we decide on the type of businesses we open they have to be ones we feel we understand. German Gymnasium is very different from Launceston Place, for example, but we all feel comfortable at supporting and managing it – otherwise it’s just pot luck.” Instead, restaurants tend to be run as individual entities by their immediate teams.

“If you’re a good guy who can run a business then that’s the DNA we want,” adds Loewi. “We look for general managers who are really mini managing directors and set them on the right rails. In some instances we write the menu, or we bring in a great chef and they will do it, but at the end of the day we will support them. It’s a fantastic opportunity for them as they are holding the keys.

“They are supported by the purchasing team, but we don’t have masses of nominated suppliers. A chef can look at them or bring their own in. We very much believe in individual businesses with individuals running them.”

Attracting top talent

D&D has a history of attracting top cheffing talent thanks to this approach; past alumni include Chris Galvin, Jeremy Lee and Tristan Welch. A number of its restaurants also hold Michelin stars as a result (Angler and Launceston Place), further reinforcing the company’s image as a place to come for solid, consistent fine dining. Its more recent recruitments, high profile former L’Anima chef Francesco Mazzei, who heads up the newly reopened Sartoria, and Frederick Forster, now at Le Pont de la Tour, will bring additional flair to its kitchens.

But what of the challenges of having such a varied portfolio of chefs and restaurants, especially when it comes to working with investors? “We’ve had private equity investors for the past five years. A lot of people say that if you own a single brand it’s easy to understand – once you open 10 you can open 100 – and wouldn’t it be much more simple to take that approach? The fact that we have a broad range of different concepts has been a huge strength for us,” says Gunewardena.

One such strength is the ability to change things. “If people don’t like the menu here we can alter it – in the tougher years we evolved our menus. It is so much easier to do that than if you have just one concept; you can’t just change one PizzaExpress. The financial guys now recognise that. Before they thought ‘oh my god these guys are opening restaurants and they might completely bomb’.”

Paris is a case in point, he adds. When Conran Restaurants first opened Alcazar there in 1998 it wasn’t an instant success. “But we evolved it so it worked.”

Evolution has certainly been the watchword for D&D in more recent times. Last year it reopened Quaglino’s following a £2.5m refurb. The catalyst wasn’t that the restaurant was underperforming but it was more of an attempt to reclaim the success of its golden era.

“Quaglino’s was still pretty successful but not as successful as when we first opened it,” says Gunewardena. “It is now more profitable than it was before so, therefore, it’s fair to say some of our portfolio that was a bit faded needed a bit more TLC.”

The return of the investment prompted D&D to revamp some of the other older restaurants in its estate. Avenue in St James’s was relaunched early last year, while Le Pont de la Tour in Shad Thames was given a makeover earlier this year. Sartoria on London’s Savile Row, which has just reopened with Mazzei behind the stove, is the latest to be given a nip and tuck.

“Sartoria is in a great location and we feel it has more potential,” says Loewi. “It’s a grown-up restaurant, with a great chef and a beautiful space. Francesco will be cooking seriously good Italian food in an environment that’s right for the Savile Row and Mayfair crowd.”

There is, however, no intention to update large swathes of the D&D estate in the near future. “I don’t look at our portfolio and see another half a dozen tired restaurants, it’s in good shape,” says Gunewardena. “Restaurants go into and out of fashion. We’ll see whether the ones we refurb this year are successful, and if they are we’ll look at it with much more knowledge and understanding than we had five or 10 years ago. But we’re certainly not just remodelling restaurants for the sake of it.”

Future plans for D&D will also involve a touch of reshaping when the group reopens its Mezzo and Floridita property in London’s Soho early next year as 100 Wardour Street. The intention is to create a 425-cover music-led venue over two floors that is both a restaurant and a late night club.

Broadening its reach

More openings are on the cards, although Gunewardena stresses the company isn’t relying on new restaurants to boost its coffers. “People say you have to open restaurants to grow. That isn’t true. If you build good quality restaurants you get growth. Our like-for-like sales are up 7% this year. Revenue is coming from our existing restaurants.”

The company does intend to broaden its geographical reach, with more UK sites outside London following the success of its first two, Crafthouse and Angelica, which opened in Leeds in 2013.

Still only two years old – a mere nipper in the D&D scheme of things – the Leeds operations have been a pleasant surprise for the pair, in spite of people telling them that they didn’t understand the Leeds market. While footfall early on in theweek is lower than in London, as expected, customers come out at the weekend in their droves and aren’t afraid to splash the cash. So much so, in fact, that the company sells as much champagne and sparkling wine up in Leeds as it does in Quaglino’s, and more per head.

“We believe in George Osborne’s ‘northern powerhouse’ and have a plan to open in more cities outside London,” says Gunewardena. “We’re very keen on opening something in Manchester, where the restaurant scene has grown significantly.”

Glasgow is also in the pipeline, with a 7,500sq ft restaurant planned as part of Land Securities’ £300m redevelopment of the Buchanan Galleries, although the time frame is dependent on the building works, meaning that it is unlikely to open before 2018.

The company is also looking at more international sites to add to ones it already operates in Paris, New York and Tokyo, although London will remain a focus. As well as 100 Wardour Street, D&D will open an ambitious 10,000sq ft restaurant at another Land Securities’ development, Nova in Victoria. Due to open in autumn 2016 in the new restaurant quarter, it will occupy two floors of the Nova South building on Victoria Street.

When it does, I’ll be more careful about what I say about it.