Restaurateurs turn to cheaper retail units to aid expansion

Intense competition and weighty premiums for A3 (restaurant) units in high-footfall areas are making operators create, and in some cases modify, branded formats to trade out of cheaper and more readily available A1 (retail) units.

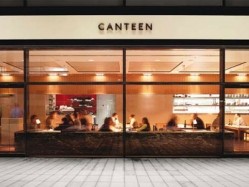

London-based restaurant group Canteen – which currently operates from four large A3 premises – has appointed Richard Edney (former development chef at Pret A Manger, a brand that owes much of its success to A1 sites) and plans to open a string of fast-casual Canteens that can be run out of A1 units.

A host of other London operators are targeting A1 sites, including Battersea Pie Station and Japanese Canteen.

The main appeal of A1 sites to the restaurant industry is their relatively high availability and lower cost coupled with the fact that businesses do not have to apply for change of use to serve certain foods from a former retail unit.

This means that operators can enter desirable, high-footfall areas without costly applications which can often be blocked by local authorities.

Terms of use

The key drawback is that primary cooking can’t take place on site (food can only be reheated) and there needs to be an emphasis on takeaway sales and limited seating. Hence the A1 catering market is dominated by sandwich-focused outfits such as Pret A Manger, which saw the potential of A1 when the Property Use Classes legislation was introduced in 1987.

“From a property perspective there is a lot of A1 availability around the 1,000 square-foot mark,” says Dominic Lake, co-founder of Canteen. “We offer traditional British food, and a surprising amount of our menu can be reworked to support non-primary cooking.”

He plans to use his existing A3 premises to supply A1 sites with pre-cooked food.

“The scope is broad,” he continues. “We could do slow-cooked lamb stew with mashed potato or hot beef sandwiches with gravy. There’s a lot of equipment out there that can perfectly hold ingredients so there aren’t as many limitations as some think.”

In sharp contrast to A3, many A1 sites can be taken on without paying a premium on the lease, significantly reducing the total amount of capital needed to open a site.

The majority of Subway’s 1,400 UK and Ireland branches trade from A1 premises, as do Oriental fast-casuals Itsu and Wasabi, two groups that have expanded at pace over the past five years.

Suited formats

Some formats and cuisines are more suited to A1 than others. Pizza and hamburger operators, which typically cook products from raw to order, struggle while other Japanese food operators and health-focused chains majoring on cold preparations are well-placed to take advantage.

Dan Levine, founder of three-strong sushi chain Mori, operates two A1 units in north London.

“Japanese food is a good fit; we don’t have an off-site production kitchen but are able to prepare almost everything on each site. Local authorities are hot on the number of seats – you have to demonstrate it is primarily a take-away shop and that means limiting your eat-in custom. They don’t seem too bothered about what happens in the kitchen, though, but we do comply with the rules.”

While there are restrictions, savvy operators can take advantage of what is generally viewed as a grey area in planning guidelines. Wasabi is able to offer a large range of hot dishes at its 20 outlets by cooking off-site and holding dishes at a set temperature. And while nobody has done it yet, the Mexican fast burrito players could theoretically make use of A1 sites as most hot product is essentially pre-made stew.

However, this blurring of the lines between the take-out sandwich shop and limited-service restaurant isn’t good news for all. A3 operators with an established pitch in a busy retail area can suddenly find themselves surrounded by cheaper, quick-turnover outfits selling similar products.

“Look at A1-focused operators such as Pret and Eat: they’re doing a lot of hot stuff now,” says Lake. “There is an overlap between sandwich shops, takeaways and restaurants and spends are comparable.

“The commercial and operational challenges are different, but if you find the right formula there are expansion opportunities on a much bigger scale than in traditional restaurants.”