Novus Leisure sold to new investors for £100m

LGV and Hutton Collins have backed the existing management team, led by chief executive Steve Richards, and John Kelly will remain as non-executive chairman.

The significant sale marks the exit of the incumbent majority shareholders Barclays Ventures and RBS Strategic Investment Group.

Record profits

“Novus has a resilient model that has served it well over the years," Richards said. "Our focus and investment in our pre-booked system has given us the ability to take market share and deliver predictable high quality earnings. These attributes have resulted in keen interest by the private equity community to invest in the next stage of Novus’ development."

Earlier this year the company announced it was on track for record profits of nearly £20m for the 12 months to June. It recently acquired the Balls Brothers and Lewis & Clarke businesses out of administration.

"In LGV and Hutton Collins we have secured investors who have an enviable record of backing successful businesses in the leisure sector. We really look forward to working with them over the next few years and to maximise the growth potential of Novus Leisure," Richards added.

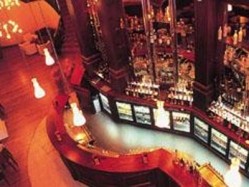

The operator, which currently has a portfolio of 52 primarily London-based premium bars, is also expected to expand outside its core to cities such as Manchester, Bristol and Leeds as a result of the deal.

Investment

Investment business Hutton Collins has in the past invested in Pizza Express and Loch Fyne and has current deals with Caffè Nero and Wagamama, while LGV Capital has invested a number of times in pubs and bars.

Bill Priestley, a managing director at private equity firm LGV Capital, said the deal would help the Novus business strengthen its existing footprint and double profitability.

"We are backing a first class management team, led by Steve Richards, and look forward to developing the business by growing the estate through acquisitions."

"This will be LGV’s fifth investment in the pubs and bars sector. We backed the original start-up of Enterprise Inns before it floated in 1995, co-funded the acquisition of The Unique Pubco, which was sold to Enterprise Inns in 2004, backed the 2008 management buy-out of The Liberation Group, the Channel Islands’ leading pub company and brewer and acquired Amber Taverns, the northern community pub specialist in 2010," he added.