In the pipeline: Planning application research reveals big appetite for new restaurants

The Christie & Co Business Outlookreleased earlier this week concluded that, despite falling high street rents, the leading businesses have become somewhat deterred by the number of retail business failures and the volume of vacant space.

But this new research, released by construction data analyst Planning Pipe, shows that there remains a high level of interest in food and drink businesses, with plans submitted for over 1100 new restaurants, bars and cafes across the UK in the final quarter of 2012.

“Whilst there is never an absolute straight line between new plans and new openings, the data provides evidence of real confidence in the hospitality sector,” said Planning Pipe’s managing director Paul Graham. “It’s the first time this kind of analysis has been undertaken, so we can’t look at trends yet. But there is clearly a picture of growth.”

New-builds

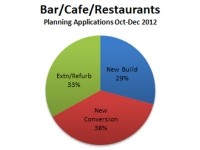

The Planning Pipe data also reveals the shape of construction activity in the sector – with planned work relatively evenly split between refurbishment, new-build and new conversion. Graham added: “While there are few surprises in where the work is planned, for those targeting new construction projects in the restaurant sector, this data gives an insight into what type of work to target”.

With relation to Christie & Co’s Business Outlook, the data does suggest that a significant amount of these new planning applications are away from the high street, but that’s not to say it has lost its appeal entirely.

As Graham points out: “Around a third of these planning applications are new-builds, which generally are not going to be in high street locations; they will be part of bigger developments which don’t tend to be in the heart of towns or cities.

“But looking at the conversions, glancing through this data you can see some site addresses which are existing sites for businesses that are now in administration, like Jessops for example.”

Application approval

The analysis revealed that wholly new food and drink establishments comprised over two thirds of all new plans – with extensions or refurbs of existing premises making up the remainder. In terms of regional divide, the South East is the most popular location for planning applications (14 per cent), just edging out London (13 per cent.

Speaking of the amount of these planning applications that actually become new food and drink businesses, Graham added: “On the commercial side of things, around 93 per cent of applications are approved.

“It costs a lot of money to put in a planning proposal so, on balance, a business is not going to submit an application if they weren’t really committed to it. It’s more a question of timing; and at what stage these projects become built.”

“Overall, this data proves that there’s a lot out there for food and drink businesses - perhaps a lot more than many people think in terms of plans for new sites in the restaurant and bar sector.”