How confident are you? Economic uncertainty provides 'new opportunities' for hospitality businesses

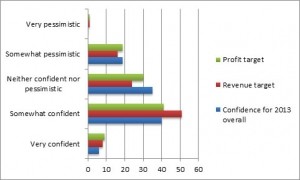

According to a survey of 100 business owners across the hospitality and leisure sector, only 19 respondents said they were ‘pessimistic’ in their outlook for 2013 – a significant drop from 30 per cent last year.

“For the UK’s hospitality and leisure sector, the start of 2013 has been chillier than hoped in several respects,” said RSM Tenon’s Jonathan Perrin. “Economic forecasters now expect GDP growth to be smaller than predicted. However, nearly half of H&L businesses surveyed remain confident about the overall outlook.”

There was more good news for the restaurant sector to be taken from the 2013 Budget.Perhaps the biggest boost for business was the creation of the ‘Employment Allowance', which will take the first £2,000 of the employer national insurance bill off of every company - this means that around 450,000 small businesses across the UK will pay no jobs tax at all.

Meanwhile, corporation tax on company profits has been cut by a further 1 per cent, and September’s 3p hike in fuel duty has also been cancelled, which could have a positive effect on delivery costs.

Opportunities

Commenting on the RSM Tenon report, Jamie Lamb, chief financial officer of hotel management company Kew Green, said: “It’s quite a positive challenge to run a business in difficult times.

“Distress in the marketplace provides opportunities, and we’re getting management contracts as owners want the best returns on their assets and people who can achieve that.”

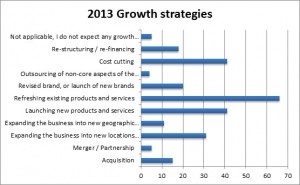

While cost-cutting remains high on the agenda, the industry is now focussed on investing in existing offerings, with 66 per cent of those polled claiming this would be their core growth strategy.

A further trend is a flight to quality and the protection of a stronger brand, especially for hoteliers. Lamb from Kew Green added: “If you have an unbranded hotel, you are at risk of declining revenues, because the world is really brand-focussed now.”

Brand designs

Prestige Hotels’ Richard Spanner claims this is also a crucial aspect for anyone seeking finance. “Banks place a lot of value against having a global brand,” he said.

In the restaurant sector, this push towards branded offerings can be seen in the success of high-end chains such as Patisserie Valerie, which has increased the number of its outlets across the UK by over 50 per cent over the past two years.

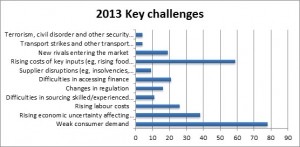

Seventy-eight per cent of respondents said a weak consumer demand topped the list of worries.

The BHA’s chief executive Ufi Ibrahim said: “The Eurozone hasn’t collapsed, the Americans may sort out their fiscal cliff, so the biggest risk may be domestic, that the UK economy will fail to lift enough to give a decent year’s trading.

Worry over rising input costs was the second-highest concern, according to 59 per cent of respondents. Seventy-six per cent expected key inputs and suppliers to increase costs this year. “Everyone is becoming creative about doing more with less resources,” added Ibrahim.

Cost & demand

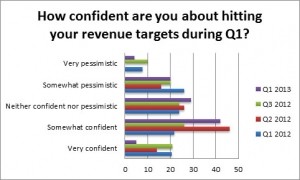

Forty-sevent per cent of hospitality and leisure businesses believed they would hit their revenue targets for the first quarter. However, while the profit outlook is not bad, with 45 per cent expecting to hit their goals, it is lower than it has been since the start of 2012.

“Costs are a big issue,” added Ibrahim. “Particularly the fixed costs and business taxes that apply.

“Generating demand is also a real struggle for many hospitality and tourism businesses, particularly in the quieter periods.”

In terms of investment, the industry is prioritising two specific areas for the quarter ahead: sales and marketing efforts, and refurbishment. “You need to keep investing in hotel products,” said Kew Green’s Lamb. “When you stop investing, it becomes obvious.”

However, the proportion of firms investing in staff training and recruitment is sharply down from last quarter.