Borel’s VAT Club calls on support from pubs

Publicans are being asked to display a magazine, entitled ‘Taxing Times’, in their establishments for customers to read. Over 500,000 copies of the magazine have been printed.

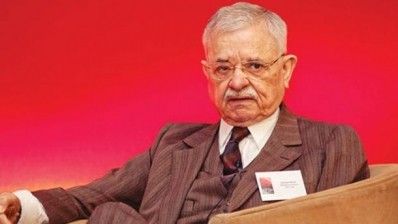

“I believe the magazine contains a number of clear reasons why publicans and pub companies should back the campaign to reduce VAT,” writes veteran campaigner Borel in his letter. “The articles in the magazine will give both you and your customers a clear understanding of the campaign and its aims.”

The eight-page magazine includes a number of articles supporting the work of the VAT Club, including comment from the likes of Kate Nicholls from the ALMR, Wetherspoon’s Tim Martin and Rob Willock, editor of our sister title, the Publican’s Morning Advertiser.

Willock’s article mentions that the current taxation on hospitality businesses gives an ‘unfair advantage’ to the supermarkets, and that the arguments to reduce tax to the proposed rate of 5 per cent are ‘compelling’.

“A cut in VAT for pubs from 20 per cent to 5 per cent would ‘level the playing field’ between pubs and supermarkets, allow pubs operators to reduce their prices and thereby attract more customers,” he writes.

Meanwhile, the Federation of Bangladeshi Caterers (FoBC) and the Asian Caterers Federation (ACF) have put their weight behind the VAT campaign and will supply over 100,000 ‘Polling Cards’ to the county’s Indian, Bangladeshi and Asian restaurants.

Parliamentary debate

The FoBC is the voice of the country’s c12,000 Bangladeshi restaurateurs and takeaway owners, while the ACF represents a community of 23,000 pan-Asian establishments.

FoBC chairman Yawar Khan said: “Restaurant customers don’t always realise that the Chancellor is taking a huge slice every time they settle their bill. Apart from the £10 VAT on every £50, restaurateurs are paying National Insurance, corporation and income tax on any profit that’s left - not to mention local council rates and excise duty.”

The FoBC has just posted a petition on www.Change.org in the hope that restaurant owners, their staff, suppliers and customers will help achieve the target of 100,000 signatories required to spark a debate on the floor of the House of Commons – as happened with the debate over beer duty.

To sign the VAT petition, click here.