Starwood Capital buys De Vere Venues

The deal, which had been on the cards since last summer, includes a collection of 23 owned and leased hotels which together comprise 2,433 bedrooms, 374 meeting rooms and 414,000 sq.ft of meeting space, predominantly in Greater London.

"We are very pleased to add De Vere Venues to our growing portfolio of attractive and well-placed assets in the United Kingdom," said Starwood Capital’s senior vice president Kevin Colket.

"The company serves a number of long-term, blue-chip corporate customers, and we look forward to building upon its reputation for operational excellence.”

It is almost a year since De Vere Group put its Venues business up for sale, with an initial price tag of between £280 million and £300m

The De Vere Venues' portfolio includes: -- Wokefield Park - 376-room freehold property situated between London and Reading

- Horsley Park - 180-room freehold property and a farm converted into meeting space situated southwest of London

- Latimer Place - 197-room freehold property spread across three buildings, including a 15th century mansion, located northwest of London

- Theobalds Park - 140-room freehold property, including an 18th century manor house, set on 55 acres of grounds, located north of London

- Staverton Park - 247-room property comprising a conference center with bedrooms, a leisure center and clubhouse, and an 18-hole golf course, located between London and Birmingham

- Milton Hill - 121-room freehold property comprising an 18th century manor house set on 22 acres of grounds, located south of Oxford

Royal Bank of Scotland Plc. and Barclays Bank provided a £140m facility to assist Starwood Capital Group in the acquisition.

De Vere was one of the hospitality businesses with a large property portfolio to be swept under the auspices of Lloyds during the recession, with debts of £1.1bn. As well as the meetings and events business, the company owns a portfolio of hotels and 25 De Vere Village Urban Resort health clubs.

Starwood's UK expansion

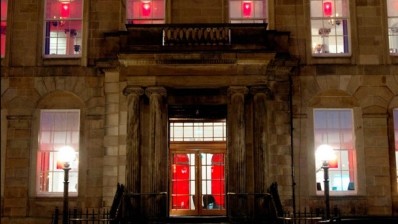

For Starwood Capital Group, this is the second major UK hotel deal of the year, having acquired UK hotel operator and owner Four Pillars Hotels in January. The US-based investment firm has been steadily increasing its European hotel portfolio and last year it also bought hotel, conference and training venue operator Principal Hayley, whose 23-strong portfolio included the flagship Grand Central hotel in Glasgow.

The Principal Hayley and Four Pillars portfolio deals, combined with this purchase of De Vere Venues, takes Starwood Capital’s investment in the UK hospitality sector to £700m over the past 13 months. Formed in 1991,the company currently has around £20bn of assets under management, with offices in Greenwich, Atlanta, San Francisco, Washington, DC, Los Angeles, Chicago and Miami, and affiliated offices in London, Luxembourg, Paris, Frankfurt and Sao Paulo.

It also owns the Louvre Hotels Group, although it sold off 40 of the groups French hotels in November last year in a move to 'reduce debt and finance more international expansion'.