Economy segment to push UK hotel performance growth

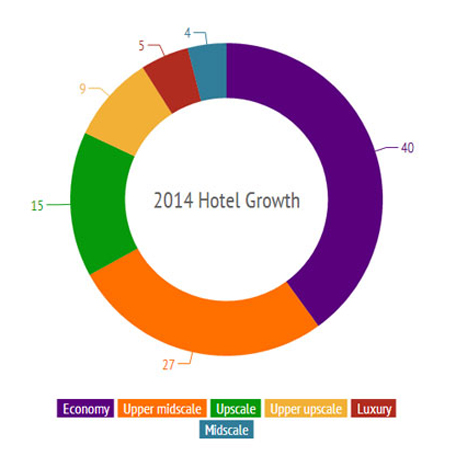

Among the new rooms in the UK pipeline for 2014, 40 per cent will be in the economy segment, according to research by STR Global. The upper midscale segment will represent 27% of new rooms opening, with upscale and upper upscale and luxury taking 15, 9 and 5 per cent of the pie respectively. The lowest performance will go to the midscale segment, with only 4 per cent.

According to the HVS Hotel Bulletin for Q1 2014, the budget market represents 50 per cent of the active pipeline in the UK, with the 4 and 5-star markets accounting for 39 per cent. However, the 3-star segment continues to suffer, representing only 3 per cent of the active pipeline in Q1 2014.

“The 3-star market has been caught in the middle – being neither budget nor luxury – and has failed to reinvent itself sufficiently well to attract investor interest. While current activity lies mainly in the budget, boutique and luxury ends of the market, it needs a brave operator to attempt to reinvent the 3-star sector,” said HVS director Tim Smith.

Despite forming a relatively small part of the UK hotel expansion plans, the midscale segment is leading the country’s revenue per available room (RevPAR) growth, along with the economy sector. Together they experienced an 11 per cent increase year-to-date in the first quarter of 2014 in London, and 14.2 per cent in the regions.

Upper midscale RevPAR also performed well in Q1 2014, up 9.7 per cent in London and 11.2 per cent in the regions, but growth was observed across the board.

UK tops European growth

The UK is leading the European pack in terms of new rooms planned for 2014, representing 38 per cent of the 3 per cent increase expected in the region. The country is followed by Russia and Germany at 14 and 9 per cent respectively. STR Global expects European demand to grow this year, following a trend of economic recovery.

The UK will experience regional disparities when it comes to hotel performance in the UK. The biggest average daily rate (ADR) increase is expected in Glasgow at almost 7 per cent, while Gatwick should see the strongest occupancy push at nearly 3 per cent. In contrast, Birmingham’s occupancy is expected to drop by almost 3 per cent. Leeds is the only other UK city where occupancy is forecast to go down, but by less than 1 per cent.

RevPAR should see strong growth across the country between 0 and 2 per cent in regional UK and Birmingham, 3 to 5 per cent in Manchester, London, Heathrow and Edinburgh, 6 to 8 percent in Leeds and Gatwick and 8 to 10 per cent in Glasgow.

In Q1 2014, year-on-year RevPAR increased by 6 per cent in London, 11 per cent in the regions and a record 22 per cent in Belfast, following strong investment ahead of the centenary year of the sinking of the Titanic, according to the HVS Hotel Bulletin. The same report showed good performance for Scottish cities, with 19 per cent RevPAR growth in Glasgow.

Aberdeen has overtaken Edinburgh as the second-highest ADR in the country at just under £100 in Q1 2014. London remains at the top of the chart at just over £120, while Edinburgh claims the third spot at almost £70, STR Global added.

London also tops the European occupancy ranking at 75 per cent in March 2014. In terms of ADR, the UK capital placed itself third, behind Paris (£184) and Zurich (£123).

Branded v. independent

In London, branded hotels largely outperformed independents, despite good overall growth in both segments, according to STR Global’s revenue generator index. However in the regions, brands and independents enjoyed very similar performances.

Everywhere in the UK, the food and beverages sales ratio showed growth, now representing 33.5 per cent of the sales mix in regional UK, compared to 26.1 per cent in London. This confirms an industry trend that is prompting hotels to rethink the way they manage their restaurants.