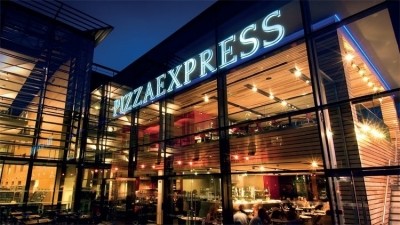

Hedge funds circle PizzaExpress

The Telegraph reports that CarVal is one of a handful of money managers to have bought into PizzaExpress’s heavily discounted corporate bonds.

According to the paper’s sources, other investors include Cyrus Capital – the Wall Street fund that has invested in airlines alongside Sir Richard Branson – and distressed debt specialist HIG Bayside.

PizzaExpress has £1.1bn of loans with some £665m of the debt formed of corporate bonds, which must be repaid starting in 2021.

Speculation has been growing around the future of the 54-year-old casual dining chain after reports earlier this month that it was preparing for debt talks with creditors.

Questions around its viability last arose back in May, when it posted a pre-tax loss of £55m for 2018, while EBITDA fell 15% to £80.2m.

Last week PizzaExpress responded to suggestions that two in every five of its restaurants are at risk of closure by saying that 95% of its estate in the UK and Ireland remained profitable.

“There are no plans for closures outside the normal course of business,” it said

The company, which operates more than 600 restaurants worldwide, has been expanding in Asia following its sale to Chinese private equity group Hony Capital in 2014.

In March this year, in a bid to 'future-proof' the business, the company began trialling an overhaul of its menu, design and service in the UK.

That same month it is also took its first steps into the grab-and-go sector with the launch of pizza by the slice concept Za in the City.