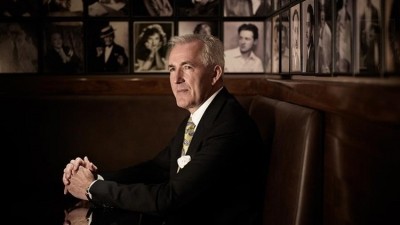

Jeremy King vows to buy back Corbin & King after group placed in administration

Minor Hotels, which acquired a majority stake in the group back in 2017, says that joint administrators have been appointed after Corbin & King Limited, the holding company for the London-based restaurant group which operates The Wolseley, Brasserie Zédel and The Delaunay, was 'unable to meet its financial obligations'.

The appointment of administrators does not affect the operations of the restaurants within the group, which continue to trade.

Describing the move by Minor as a power play, King says he and co-founder Chris Corbin planned to buy Corbin & King Limited out of administration.

“There is absolutely no need to go into administration – we are trading extremely well and all suppliers, staff etc continue to be paid.

“It is a power play for the holding company – and we plan to thwart the move by buying it back out of administration.”

This latest development follows an extraordinary breakdown in the relationship between King and his investors, with the former reportedly refusing offers of financial support according to Minor.

Over the weekend it was reported that Corbin & King had filed a motion in the High Court to stop Minor calling in a £35m loan, which would have forced it into insolvency.

Major liquidity constraints

Minor says that prior to the appointment of the administrators, an attempt to place an unauthorised moratorium filing was made without board approval and was subsequently required to be withdrawn.

It claims the group is facing major liquidity constraints and has defaulted under its shareholder and third-party loan obligations since May 2020, adding that the company requires strong financial support for the sake of the outstanding employees and brands within the Corbin & King Group to survive and succeed.

As the largest lender to the business, having already provided £38m worth of direct loans and loan guarantees, Minor says it remains committed to supporting the Corbin & King group through this period of uncertainty.

The Thailand-based investor says it has made repeated proposals to recapitalise the company and continuously pushed the board for cash injection to support the sustainability of the business, but that King and the other shareholders have declined Minor's proposals and left it with no other viable option than to appoint administrators to the business.

Geoff Rowley and Ian Corfield, partners at business advisory firm FRP, have been appointed to oversee the process.

Dillip Rajakarier, group CEO of Minor International, says: “After all our offers to put the company on a strong financial standing have been rejected by Mr King, we have had no choice but to take the responsible step and put Corbin & King Limited into administration.

"The loans have been in default since May 2020 and we are required to act in the best interest of the company’s stakeholders.

"Contrary to the picture that Mr King is trying to paint, the business is insolvent and is in strong need of further financial support. Minor is prepared to offer this support to secure the long-term future of Corbin & King’s employees and restaurants.”

Minor adds that it is confident that with the right financial support, strong financial discipline and a sound business model, Corbin & King Limited 'will not only survive but thrive' in the post-pandemic environment.

Possible new investment

Yesterday, prior to Minor releasing a statement confirming the insolvency, it was reported by Sky News that Knighthead Capital Management was in talks with King about providing tens of millions of pounds of funding to the group.

The dispute with Minor is also being played out against the backdrop of a separate legal case that has seen Corbin & King suing Axa for refusing to pay out a claim for loss of business during Covid-19 lockdowns.

Speaking in conversation with BigHospitality editor Stefan Chomka at the MCA Restaurant Conference last November, King said that life was 'a lot happier' when he had control over his own restaurant group.

“When we had Caprice, we had 100% of the business. Life was a lot easier. It was utopian," he said.

“I’m often asked what’s the best way to open a restaurant. I say keep it modest and keep 100% control.”