Knighthead tables £38m rescue deal for Corbin & King

Sky News reports that Knighthead has notified administrators to Corbin & King that it is prepared to refinance all outstanding loans owed to majority investor Minor International.

The development came hours after the restaurant group was forced into administration by Minor Hotels, its biggest shareholder and lender.

Knighthead has retained the investment bank PJT Partners to advise it on its interest in the business, which is understood to date from the early part of the pandemic.

Minor announced on Tuesday (25 January) that it had called in FRP Advisory as administrators to Corbin & King’s holding company, which owns restaurants including The Delaunay and Colbert.

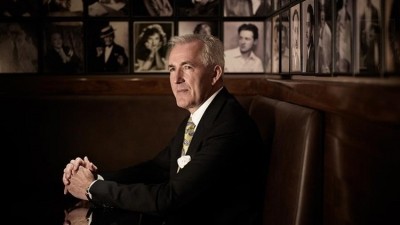

It follows an extraordinary breakdown in the relationship between Corbin & King co-founder and CEO Jeremy King and Minor.

Over the weekend it was reported that Corbin & King had filed a motion in the High Court to stop Minor calling in a £35m loan, which would have forced it into insolvency.

The group's sites are continuing to trade, and a source close to the situation said Knighthead’s offer would allow the business to continue to pay suppliers, employees and landlords.

Minor said having already provided £38m worth of direct loans and loan guarantees, it 'remained committed to supporting Corbin & King through this period of uncertainty', but King described the decision to place the group into administration as a power play and has vowed to buy back the group that bears his and business partner Chris Corbin's name.

“There is absolutely no need to go into administration – we are trading extremely well and all suppliers, staff etc continue to be paid,” he said.

“It is a power play for the holding company – and we plan to thwart the move by buying it back out of administration.”