Richard Caring 'not intending to pursue' Corbin & King acquisition

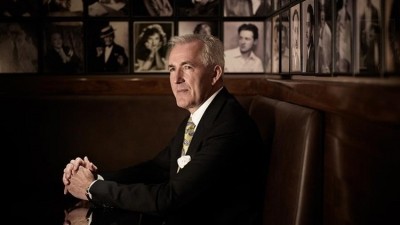

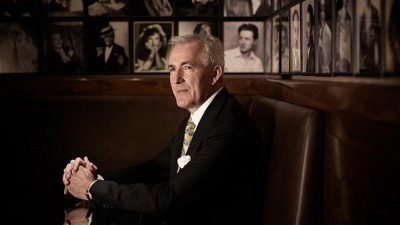

Caring, the restaurateur and private members’ club mogul who backs The Ivy Collection, Bill’s and Soho House, had reportedly been billed as an 'early frontrunner' to takeover Corbin & King after Minor International, which acquired a majority stake in the London-based group back in 2017, placed it into administration late last month having said it was 'unable to meet its financial obligations'.

It followed an extraordinary breakdown in the relationship between Minor and Corbin & King co-founder and CEO Jeremy King, and came after the restaurant group, whose estate includes The Wolseley, Brasserie Zédel and The Delaunay, filed a motion in the High Court to stop Minor calling in a £35m loan that would have forced it into insolvency.

The Times previously reported that one of Caring’s representatives had met with Minor, and Caring himself was expected to speak to the Thai investor early last week.

Now, though, the paper has revealed that Caring has dropped out of the running.

Caring told The Sunday Times this weekend that “at this moment, I am not intending to pursue” a deal.

King has described Minor's decision to call in administrators as a power play and has vowed to buy back the group that bears his and business partner Chris Corbin's name and pay back all the monies due.

Speaking in a video posted on YouTube, the restaurateur described his business as being 'under siege' from Minor and insisted that the company is 'in rude health and as profitable as ever'.

He also refuted claims that Corbin & King couldn’t meet its financial obligations, saying that the only obligations it failed to meet were in respect to a £30m loan from Minor as part of the transaction when it bought into the company; and rejected the assertion that the company faced major liquidity constraints throughout the pandemic, saying that it didn’t require any financial support other than the Government’s furlough scheme.

Sky News has previously reported that US investment fund Knighthead Capital Management has notified administrators to Corbin & King that it is prepared to refinance all outstanding loans owed to Minor.

The appointment of administrators does not affect the operations of the restaurants within the group, which continue to trade.