Generation Next

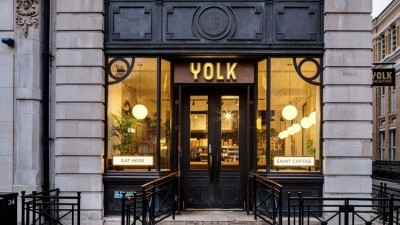

Inside Yolk – the brand looking to disrupt London’s grab-and-go market

As Nick Philpot puts it, Yolk, the ‘fine fast food’ brand he launched back in 2015, was born primarily out of a personal frustration. “I was just really irritated with the poor quality of grab and go food to be honest with you,” he says, when asked what propelled him to ditch a prosperous career in consulting for what is, one would imagine, a much more stressful life in hospitality.

“It’s a classic industry to hospitality tale, born out of lived experience,” he continues. “I used to work in central London. It was long office hours, and there were times when I was having to eat at my desk three times a day; and I was just so bored of what was being offered by the major grab-and-go operators. I’m not talking in terms of quality or speed of service, but the range of food available. It was so dull.”

At the time, Philpot viewed London’s grab-and-go market as being split into two distinct areas. First, there was the convenience-led space, inhabited by the likes of Pret a Manger and the now defunct EAT - mainly sandwich focused, with a few extras here and there. And then there was the health-led options – the Leon and Itsu brands, for example, which played heavily on the idea of offering fresher and more nutritious meal options.

“Both approaches have their own niche, but it often comes at the expense of flavour and excitement,” Philpot continues. “I could see how busy these places where, but based on my own discussions with colleagues, nobody loved what they were offering. It just served a purpose.”

Cracking the market

Thus, Philpot set to work creating his own quick-service brand offering a menu of tasty, high-quality dishes made fresh to order pitched at a price point that could compete with already established brands. A takeaway option that ‘didn’t compromise on excitement’, as he puts it.

The result was Yolk. “I wanted to do something where the food was accessible and tasted amazing. It wasn’t about trying to create a market for something new, it was a desire to try to create something better than what currently existed.”

Even though Yolk launched in 2015, it wasn’t until 2018 that Philpot put down permanent roots with the launch of his first bricks and mortar site on New Street Square in the City. “There were years of trying and failing at pop-ups in between,” he says, noting that he continued to work in consulting for a large portion of those intervening years.

With no formal hospitality experience, Philpot learnt the ins and outs of industry on the job, while also working to hone the concept. As well as residencies and pop-up stalls, he spent time working the street food scene as a KERB operator, and even took Yolk on the festival circuit.

“We had plenty of triumphs in those early days, but we also had a number of disasters,” he recalls. These included having to contend with the realities of running a pop-up stall in endless torrential rain; and a ‘disastrous’ evening residency in Soho that failed to bring in a single customer on its opening night.

“That was a pretty sobering experience,” admits Philpot. “But it was also very instructive. Stuff like that sharpened my focus on making sure we got the right location when we did eventually move into bricks and mortar.”

It certainly paid off. Yolk’s first location was a success with hungry City workers looking for a new lunchtime staple, and the group subsequently launched a second site in 2019, in Broadgate. This year the brand has taken it up a gear, with new openings in Soho, Canary Wharf and most recently London Bridge. And now Philpot, who leads the company with lead investor and co-founder Alkesh Tandon, has his eye on wider expansion.

“We’ve got five now, and sites six and seven are currently in various stages of legal negotiations, which we hope to get open in the next six months or so. That’s already a big acceleration for us. We moved very slowly to begin with, but we feel we’re now in a position where we can do that.”

Going to work on an egg

Curiously, despite the name, Yolk doesn’t really fit into the growing market of egg-focused breakfast and brunch concepts – the likes of Egg Slut and Egg Run – that have hatched within the fast casual space in recent years.

“We don’t see ourselves as occupying that market really,” says Philpot. “They’re much more separate, conceptually. Their sites are often neighbourhood locations with plenty of seating, which we might do down the line, but it’s not something we’re looking at right now.

“I’m into brands like that, though. I was always frustrated by the paucity of breakfast options, but I think that’s shifting. And places like that show there is an underserved demand for it.”

Philpot describes the breakfast menus he used to encounter during his years in consulting as often feeling like an afterthought, and as such the breakfast offering at Yolk has constantly been an area of development and focus. Served between 7am and 11am across all sites, the Yolk breakfast menu includes fresh pastries and a range of ‘brekkie baps’ including a classic bacon bap; an avocado and mushroom bap; and an egg and cheese melt.

So far so ordinary, but Philpot believes one of the areas where Yolk sets itself apart from the chains that dominate the grab-and-go market is with its poached egg pots, which are made fresh to order in about the same length of time as it would take to get a McMuffin at the Golden Arches. “They’re definitely a favourite on the menu,” he says. “And they’re probably the thing I’m most proud of.”

The signature dish on the menu is a ‘benedict’ pot featuring pulled ham hock, poached eggs, house hollandaise, and cayenne pepper. Other options include a ‘royale’ pot that swaps the ham hock for salmon; a smashed avocado and egg pot with tomato, chilli, lime and coriander; and a roasted Portobello mushroom pot with parsley oil and parmesan-sourdough crumb.

As it is across the board, pricing of the breakfast menu is kept as approachable as possible despite the high-quality of the ingredients, which includes St. Ewe eggs. Poached egg pots start at under £4, with only one dish across the whole breakfast range breaking the £5 mark.

“We really want to make Yolk something we can grow and that can be scalable, and price point is a huge part of that. We’re still towards the slightly more expensive end of grab and go, but it’s competitive.”

Maintaining the right price point

Keeping a similarly accessible price point on the lunch menu has proven to be an even greater challenge and the company has worked hard to keep lunch items in the £6 to £8 mark. “If we move more into the £8 to £10 bracket then, while some people will still come and our margins would be better, it will become a treat-only place for many customers. And we want to remain somewhere that people come daily, at least; maybe even twice a day.”

Yolk’s lunch menu includes a selection of rice pots and salad bowls, but it’s the range of deep-filled ciabatta sandwiches that have proven to be the main draw. As with the breakfast menu, all fillings are prepped and cooked on site, with the sandwiches then prepared to order in a similarly speedy timeframe to the breakfast menu.

There’s no egg mayonnaise or prawn cocktail on offer here; instead, Yolk’s menu includes a nduja club sandwich with freshly roasted chicken, sweetcure streaky bacon, nduja mayo, tomato and lettuce; the bang-bang shroom with soy-glazed portobello mushroom, peanut sauce, coriander, carrot, pickled daikon and sesame; and a chicken and avocado option with freshly-roasted chicken, avocado, ‘secret sauce’, sesame, pickled daikon and mayonnaise.

The signature, meanwhile, is a steak béarnaise sandwich using grass-fed steak cooked medium rare and served with house béarnaise, rocket and caramelised balsamic onion. Priced at £8.20, it’s one of the most expensive items on the Yolk lunch menu, with most of the sandwiches coming in at between £6 and £7.50.

Yolk achieves its price point by elevating relatively cheap cuts of meat. Bavette, for example, is used for the steak sandwich, which is sous vide overnight to make it tender and more consistent.

A shifting strategy

One challenge with which Philpot has had to contend is the rise in hybrid working brought about by the pandemic. Whereas before, Yolk’s sites in the City were consistently busy throughout the working week, now there’s a noticeable dip in trade on Mondays and Fridays.

“It’s loads of up and down, but we are basically where we were pre-Covid. The tricky thing for us is that Friday used to be a big day, but it isn’t quite what it was. And that’s shifted elements of the strategy.” This has included exploring the addition of an evening menu, which is currently being trialled at the group’s New Street Square site.

“It’s an evolution that makes sense with our brand feel and aesthetic. We always thought we had a feel that could segue into the evenings but have never engaged with it before. You can’t just rely on being busy at breakfast and lunch anymore. It worked before the pandemic, but now it’s about exploring other opportunities and sharpening our focus.”

Yolk’s evening menu is stylistically similar to its lunch offer, split between a range of bowls that are all served with spiced, skin-on chips and greens; and burger bun-style sandwiches. In both instances, Philpot was keen to ensure there wasn’t much crossover in terms of fillings, in order to distinguish the dinner menu from the lunch one. Options include a chicken parm bun with breaded and spiced chicken thigh fillet, slow-cooked tomato sauce, olive-jalapeno relish, melted mozzarella, rocket and basil; and a fish and chip bowl with cod fillet, house hollandaise sauce and minted smashed garden peas.

Prices are pitched slightly higher than they are at lunch, but primarily hover around the £9-£10 mark. “As with everything, we’re trying to keep it competitive,” says Philpot. “The response so far has been positive. It’s not as intense as lunch, but the appetite for it is building.”

Big ambitions

Philpot notes that the pandemic has changed Yolk’s strategy in other ways, too. While previously the group was entirely focused on five-day operations in central and City locations, it’s also now looking at ‘office plus’ areas, as he calls them, like Canary Wharf, which benefit from both office and residential footfall, with a view to opening those sites seven days a week.

Then there’s the impact Covid had on Yolk’s chief high street rivals, many of which were forced to close sites or enter into Company Voluntary Arrangements (CVA) as a result of the pandemic. “We think it’s really great time for a small ambitious business like us that’s trying to grow, as we can get opportunities that we wouldn’t have gotten before.”

“Landlords are looking at things a bit more holistically. Previously, it was all about covenant, but with Covid and all the CVAs it showed that larger firms can’t always be relied on to pay rent. It doesn’t mean they’ll never go with them, but they’re more open-minded about taking a chance on a brand like ours’.”

While Philpot doesn’t want to think too far ahead, he does have big ideas about how much the brand could grow in the future. “We’re super ambitious. In terms of London, we look at brands like Leon that has more than 50 sites and we see no reason why we can’t do that. And then I think there’s a lot of opportunity beyond that too.”

That includes taking the brand beyond the capital, with Manchester mooted as a possible target area; and potentially into transport hubs including train stations and airports. There’s even the suggestion of making a move into the roadside dining space further down the line.

“It’s good to have a big, scary dream to aim for, but I do always have to check myself when thinking about the future as we’re still only a small business. But we’re open about our ideas; there’s a lot we want to achieve, and I believe we can make it.”

![220209_Yolk_Nick_020_(1)[1]](/var/wrbm_gb_hospitality/storage/images/media/images/220209_yolk_nick_020_-1-1/5917895-1-eng-GB/220209_Yolk_Nick_020_-1-1.jpg)

![220209_Yolk_Social_002_(1)[1]](/var/wrbm_gb_hospitality/storage/images/media/images/220209_yolk_social_002_-1-1/5917859-1-eng-GB/220209_Yolk_Social_002_-1-1.jpg)