Brasserie Bar Co builds 'strong pipeline' of freeholds

The group, which operates the Brasserie Blanc restaurant and White Brasserie pub chains, achieved 'record-breaking' sales for the year to 26 June 2022 of £57.5m, as reported in its latest accounts at Companies House, with trading strong in the period since.

Brasserie Bar Co is focused on expanding its White Brasserie division, and is committed to buying only freehold sites from now on, in order to strengthen the asset base of the group and improve financial stability.

Since the year end it has acquired eight freeholds from its existing portfolio, for the combined total cost of £26.5m, and invested £5.8m in a further three new freehold pubs, the first of which, The Britannia, Parkstone, opened in October 2022.

These acquisitions were funded through a combination of shareholder investment of £14.7m and bank debt of £20.1m.

As was first reported last year, the group is also currently exploring growth in the pubs-with-rooms market and is in active discussions on securing a pipeline of new sites to open in the coming years.

It spent much of the middle part of the last financial year developing plans to resolve the issue of being under capitalised, and following interest from two distinct parties, the business was sold to Alchemy in February 2022.

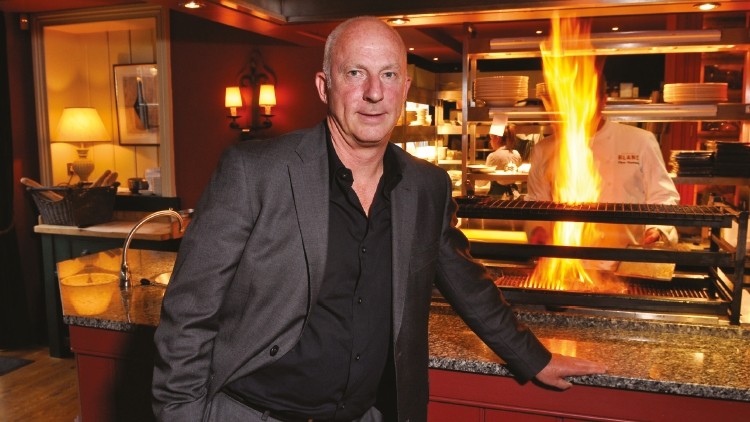

Speaking to MCA, Restaurant's sister site, Derry explained that in the year since, the group has been 'steading the ship, buying in our own properties and has got started on our strategy of buying new freeholds – we are making progress and doing well'.

In the accounts filed by Abriand Topco – the ultimate controlling party – the group reported restaurant EBITDA of £12.8m for FY21/22 – more than double the figure of £6.1m achieved the previous year.

The business improved its gross margin from 73.4% to 74.8%, due to continued strong margin control and aided by the reduced rate of VAT over the period.

It recorded an overall loss after tax of £1.6m for the year – an improvement on the loss after tax of £2.7m in 2021, despite refinancing and restructuring costs incurred during the period of £5.4m, compared to £1.5m in 2021.

Gross sales were up £2.8m, or 5.9%, excluding the impact of Omicron, compared to the 12 months to February 2020 – the nearest comparable period.

Trade in the autumn was strong, and despite the cancellations due to Omicron over the Christmas period, sales and profits remained ahead of budget to the year end.

“Alongside this we managed to secure the long-term future of the business by achieving a more normalised debt level and introducing additional capital for future growth,” Derry noted in his statement accompanying the accounts.

Debt facilities have been increased from £20m to £35m and drawn borrowings have been reduced from £22.8m to £14m, consequently net debt has improved from £12.1m to £8.3m.

“The group is now well positioned for future development and expansion in 2023 and beyond,” Derry said.

Post the initial acquisition of the business by Alchemy, a further £15m of shareholder funds has been invested in the group.

“We are confident that adequate funds will remain available to support our growth aspirations.”

The group operated 14 Brasserie Blanc sites and 18 White Brasseries during the period.