Budget 2010: Alcohol duty to rise 'as planned'

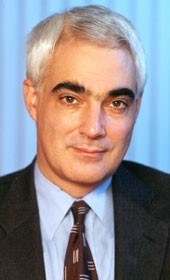

Duty on alcohol is set to increase by another 2 per cent above inflation as planned under Chancellor Alistair Darling's tax escalator, despite pleas from the trade to halt it.

Announcing the news as part of the Budget today, Darling also said cider, exempt from the tax escalator so far, will be brought into line with other drinks with duty set to rise by 10 per cent above inflation from 1 April.

Although trade groups such as the British Beer & Pub Association (BBPA) and the Wine & Spirit Trade Association (WSTA) had campaigned for the rise to be halted, the Chancellor went ahead with his plans.

The news means that duty on beer will rise by a total of 5 per cent, adding about 10p to the price of a pint while the tax on cider will rise by a total of 13 per cent.

The WSTA said a bottle of wine will increase by about 10p a bottle while a bottle of 70cl spirits will rise by about 36p.

BBPA chief executive Brigid Simmonds said the latest tax hike would add to the 'misery for Britain's hard-pressed pubs and beer lovers.'

"Since 2008, beer tax has increased by an eye-watering 26 per cent – a £761 million tax rise - and we have seen the loss of 4,000 pubs and over 40,000 jobs up and down the country. Beer sales are down £650m in the last year alone.”

"The Chancellor’s claims that this is a Budget for investment and growth are hollow, considering he’s just hit the beer and pub sector with a £161 million tax rise. The extension of the tax escalator for an extra two years also means more pain."

Business rates

There was some good news for businesses, however, as Darling said he was cutting business rates for a year from October, meaning a tax reduction for 500,000 small companies in England.

The annual investment allowance will also be doubled to help new companies get off the ground while the relief on capital gains tax for entrepreneurs will be increased and will remain unchanged for other businesses.