business profile

Sowing the seeds of success: how Farmer J is disrupting lunch al desko

Farmer J might compete with the likes of Pret a Manger, Leon, and Itsu for the officer worker pound, but the business sits in a slightly different category with a higher price point and a focus on quality non-packaged food made largely from scratch at each of its 10 locations.

Launched in 2014 (it opened its first bricks and mortar site in 2016), the rapidly-expanding fast casual group is the creation of Jonathan Recanati, a hospitality management graduate and former Deutsche Bank analyst who became disillusioned with his options for breakfast, lunch and dinner al desko while putting in the hours in the City.

“I often used to eat three meals a day in the office,” says Recanati, who runs the business with his wife Ali, a former lawyer. “At the time the going price for an office worker meal was about £7. The food was very average, and the in-store experience wasn’t great either. I decided that I wanted to fix that by launching a brand that offered a good culinary experience and a good restaurant experience.”

Recanati – whose role was to assess the eligibility of businesses in turnaround situations for high risk, high return loans – used his bank’s research department to analyse the office lunch market, pulling data on successful companies like Chipotle (the US-centric burrito giant that has a modest UK presence) and Sweet Greens (another successful US brand focused on the office lunch market).

"I wanted to see what the scale potential would be," he says. "If you do something well, how big can it be?”

Taking Farmer J transatlantic

The answer, according to Recanati, is very big indeed. He believes Farmer J has the potential to take its ‘honest food straight from farm-to-fork’ global. Earlier this year, the business took its first step to doing just that, securing a £5.5m investment from transatlantic venture capital firm Beringea that will partly be used to fund a toehold in the US market next year.

“The fast casual space in the States is a massive market. It’s competitive, but I would not say it is overcrowded. There is still space for good operators,” says Recanati, who acknowledges that the track record of UK-founded brands looking to crack this segment of the US market is not great.

“Of course, there will be tweaks. But Farmer J ticks a lot of boxes including what it stands for, the type of food we serve and the speed of service. On top of that, Farmer J is not really a British brand. There is nothing British about our food other than our ingredients.”

Farmer J is now looking at sites in East Coast US cities including New York and Boston, which are both strong markets with lots of affluent young professionals and high population densities. The large cash injection from Beringea – which follows smaller investments from UK-based private equity houses Edition Capital and Imbiba – will also be used to increase Farmer J’s footprint in the capital with five or six sites set to launch before the year is out.

Keeping throughput front of mind

As one would expect given the interest from institutional investors, Farmer J’s 10 London sites are performing strongly. The business turned over around £18m last year and reported strong like-for-like sales in January with individual locations up between 10% and 15%. At site level, EBITDA is ‘in the high teens’.

Larger sites can serve up to 1,500 customers a day. Front of mind at all times for Recanati is throughput. Eschewing pre-packaged food means it can’t compete with the likes of Pret and Itsu on convenience but with office workers put off by long waits speed is still the name of the game.

Its larger sites can serve between 300 and 400 an hour at lunchtimes and getting people served quickly is something the company has put a lot of effort into. It has 'drastically' increased the speed of Its coffee service and some of its sites now have separate production lines for delivery and click-and-collect orders.

The majority of Farmer J’s sales are consumed off premise with delivery accounting for between 20% to 25% of sales. The business works with Deliveroo on an exclusive basis, but corporate catering is available via other platforms.

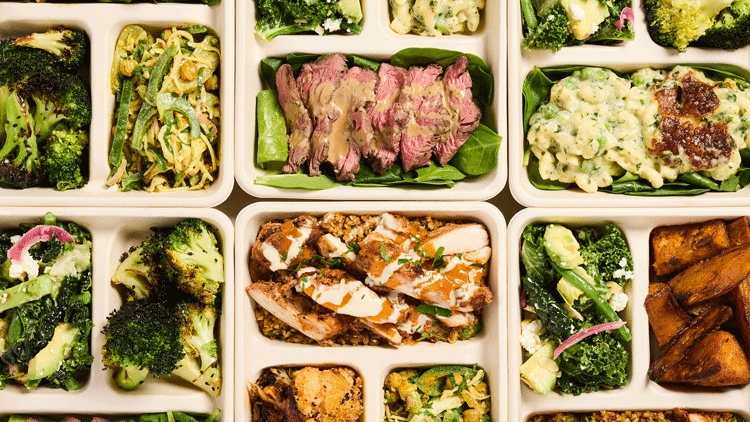

At lunch, the offer is focused on Field Trays and smaller Field Bowls. Diners choose a carbohydrate or salad base, a main protein – options include gochujang-glazed salmon and charred flank steak – a side and a sauce. There is also a tight but well-thought out breakfast offer comprised of egg pots, breakfast rolls, porridge and overnight oats.

Earlier this year, Farmer J’s Field Tray tipped over the £10 mark (it is currently priced at £10.50). “It's far less of a psychological barrier than I thought it might be," Recanati says of the move. "We have not seen a dip in sales and have not had any negative feedback.”

The increase in price is partly due to ongoing food price inflation and increases in packaging costs linked to the problems in the Suez Canal but mainly due to the upcoming hike in minimum wage, which will push up the company's wage bills and likely the prices suppliers charge too.

Paradoxically, the rising cost of doing business is helpful to Recanati because it closes the gap between Farmer J and its lower-priced rivals. “Brands that were once perceived as cheap and cheerful are now moving closer to our price point, which makes us look better value. I don’t want to name names, but in some cases, you can spend an extra £1 or £2 and get a freshly cooked, balanced meal from us.”

A farm-to-fork approach

What exactly is the criteria for a Farmer J dish? Unlike pretty much anyone else in the office lunch space, the brand looks to source ingredients that are in season from UK suppliers. Ideally, products are sourced from a single farm.

The company visits the farms it works with and builds a story around a particular ingredient. Recently it as in Spalding in Lincolnshire with the farmer that grows its kale and spring greens. "As we get bigger, we have more buying power, which makes it easier to work with our fruit and vegetable supplier to identify suitable farms.”

While the focus is on fresh, high-quality ingredients Farmer J’s price point precludes organic in most cases especially when it comes to fish and meat. Though it’s not positioned as a health food brand, meals are intended to be balanced. “They fill you up, but you can go back to work afterwards. Our food is designed to make people feel good."

Another thing that sets Farmer J apart from the majority of its competitors is that it does not have a centralised production kitchen. "We are managing without one for the moment. Not having one means things are very fresh. The big challenge is deliveries as we are getting quite big for our suppliers. We may look at centralising distribution and I would not rule out a centralised production kitchen at some point further down the line.”

Heading to the regions

Farmer J’s sites have a notably more premium feel than the competition with high-spec fit outs, high quality staff uniforms and food presented in pricey Staub casseroles. While that does come at a cost, Recanati admits, it's about trying to build a brand. "At the moment our return on investment is good," he says. "We aim for pay back in two or three years and so far, we are achieving that.”

At present, Farmer J is City-centric, with a little over half of its estate in and around the Square Mile. Most of the rest of its sites are in prime West End locations including Oxford Circus and Covent Garden. As such it typically serves a customer that isn’t that price sensitive.

Average spend is about £12 gross for in-store sales and click-and-collect, which will be a bit of an ask when Farmer J heads to the regions next year. The plan is for the brand to ‘build its confidence’ in relatively affluent places including Manchester, Cambridge, Oxford, and Brighton. “We need to test the waters. £12 for a takeaway meal outside London is a lot. For that reason, I don’t see us opening hundreds of stores across the UK.”

The brand is expanding in other areas, too. Six months ago it became a true omnichannel brand by adding a selection of products to its website including a selection of the spices, sauces and grains it uses in its restaurant.

“It will evolve into another revenue stream," says Recanati. "We will eventually launch a full retail line but that takes investment and focus.

"This is setting the scene for what is going to happen in the future. But right now the priority is to expand our bricks and mortar business.”