Cut Tourism VAT: Campaign group calls on regional communities for support

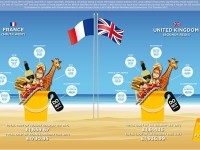

Led by Cut Tourism VAT, the campaign aims to make British holiday makers more aware that Britain is one of only four countries in the EU to charge VAT on tourism at the full 20 per cent – more than double the rate of our counterparts in France and Germany for a domestic holiday.

“Britain is such a great country with so much to do that we should be making it easy for people to holiday at home,” said the British Hospitality Associaiton’s chief executive Ufi Ibrahim. “The current VAT levels are making it hard for us to compete with cheap resorts abroad. As a result Britain's hospitality industry is suffering.

"We have so much to offer and it's madness not to allow our hotels, resorts and attractions to compete on a level playing field with our European neighbours.

"It might not be the sexiest subject in the world but VAT is an important one. Cutting tourism VAT in the UK to 5 per cent can benefit everyone, from the average Brit holidaying at home or keeping their children entertained in the school holidays; to local hotels, B&Bs and restaurants trying to survive; to local jobseekers looking for work.”

The Campaign has produced an infographic showing how UK holidays struggle to compete with comparable holidays in France; a country which enjoys a 7 per cent VAT rate on items such as visitor accommodation. View the full infographic on our Facebook page.

Economic boost

It comes hot off the heels of a national survey by the Cut Tourism VAT Campaign which reveals that 86 per cent of Brits consider the cost when choosing to go on holiday, with a quarter even saying it’s the most important factor in deciding when and where to go.

Despite a recent report showing that 65 per cent of British adults are taking a staycation this year– up from 41 per cent last year and 35 per cent in 2011 - eight out of 10 of the people polled by Cut Tourism VAT admitted they would be more likely to holiday in the UK if hotels, attractions and holidays parks in this country were cheaper.

Graham Wason, chairman of the Cut Tourism VAT campaign, said: “Victory for this regional Campaign would mean British families being able to enjoy more holidays and breaks in their own country. It would also mean greater tourism spend, investment and jobs in communities where tourism is a key part of the local economy.”

David Cam, director of the Pleasure Beach at Blackpool – which is the ninth most popular staycation destination in the UK – added: “Tourism is one of the most important industries in the country, a fact acknowledged by successive Prime Ministers. However, the Treasury appear blind to the extraordinary opportunities which a reduced level of VAT on tourism products bring to the British economy.

“Not only would the Staycation concept develop rapidly but there are millions of foreign tourists who perceive the UK is extremely expensive and would be encouraged to visit here should VAT see a reduction."